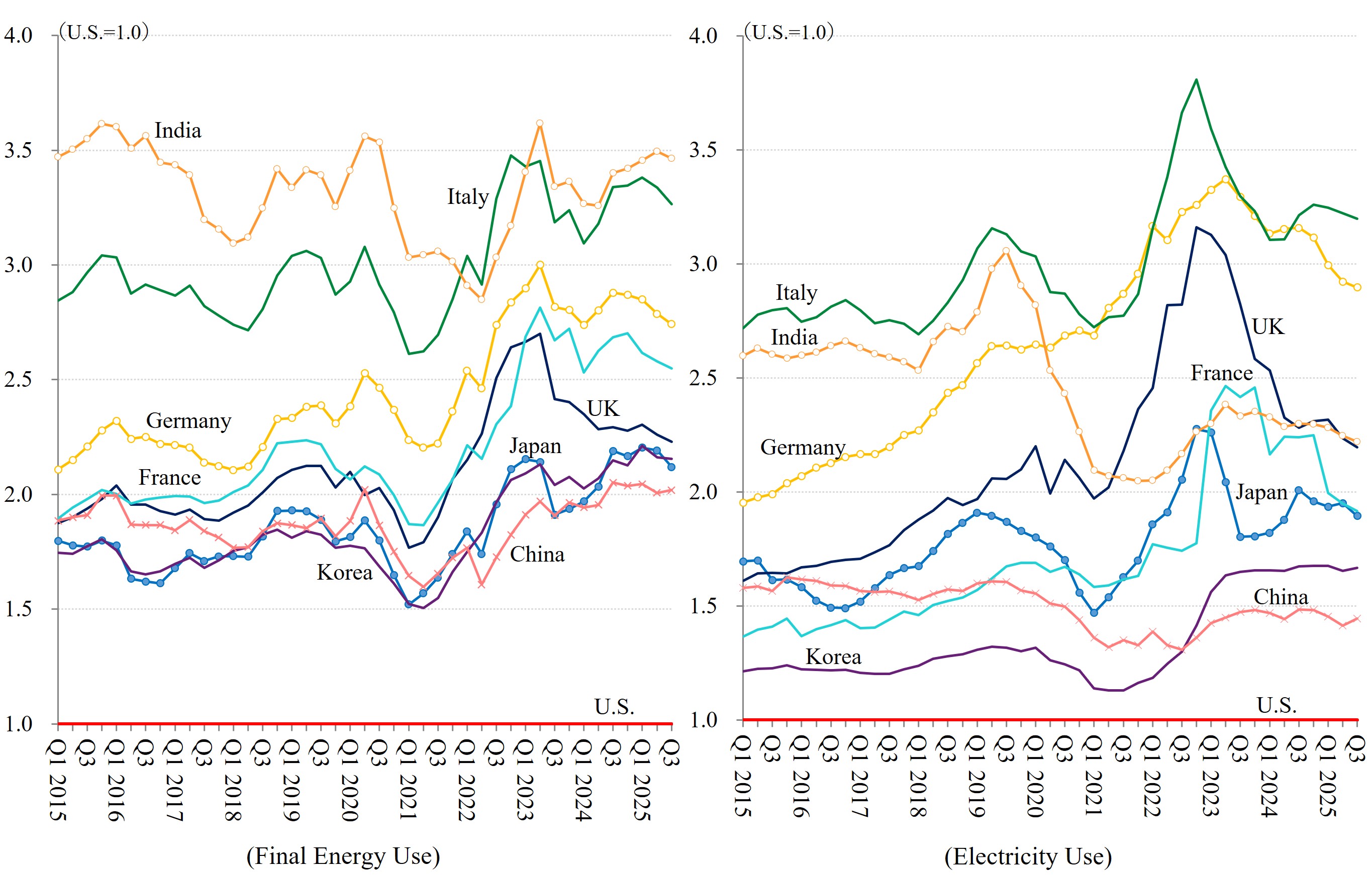

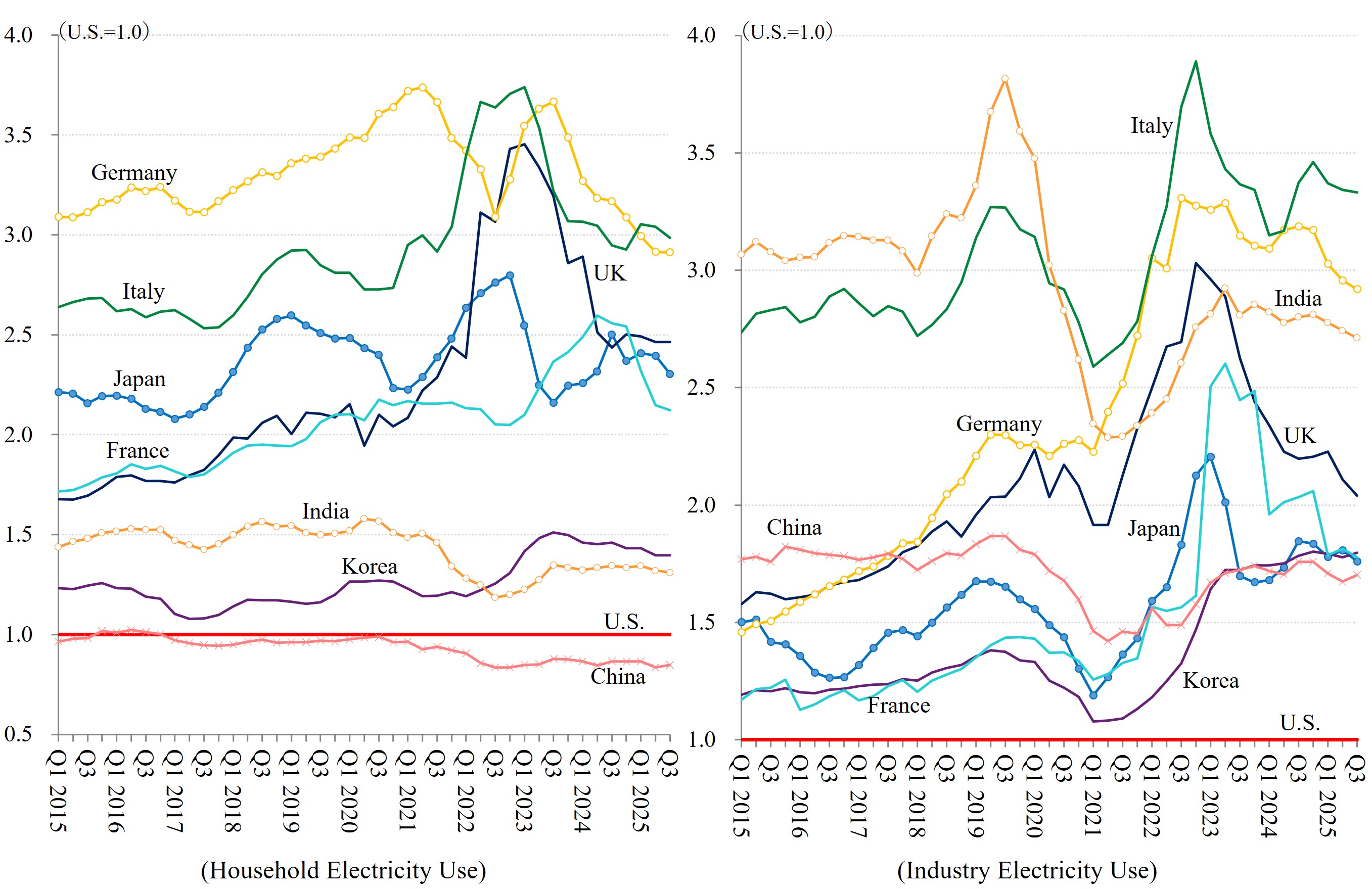

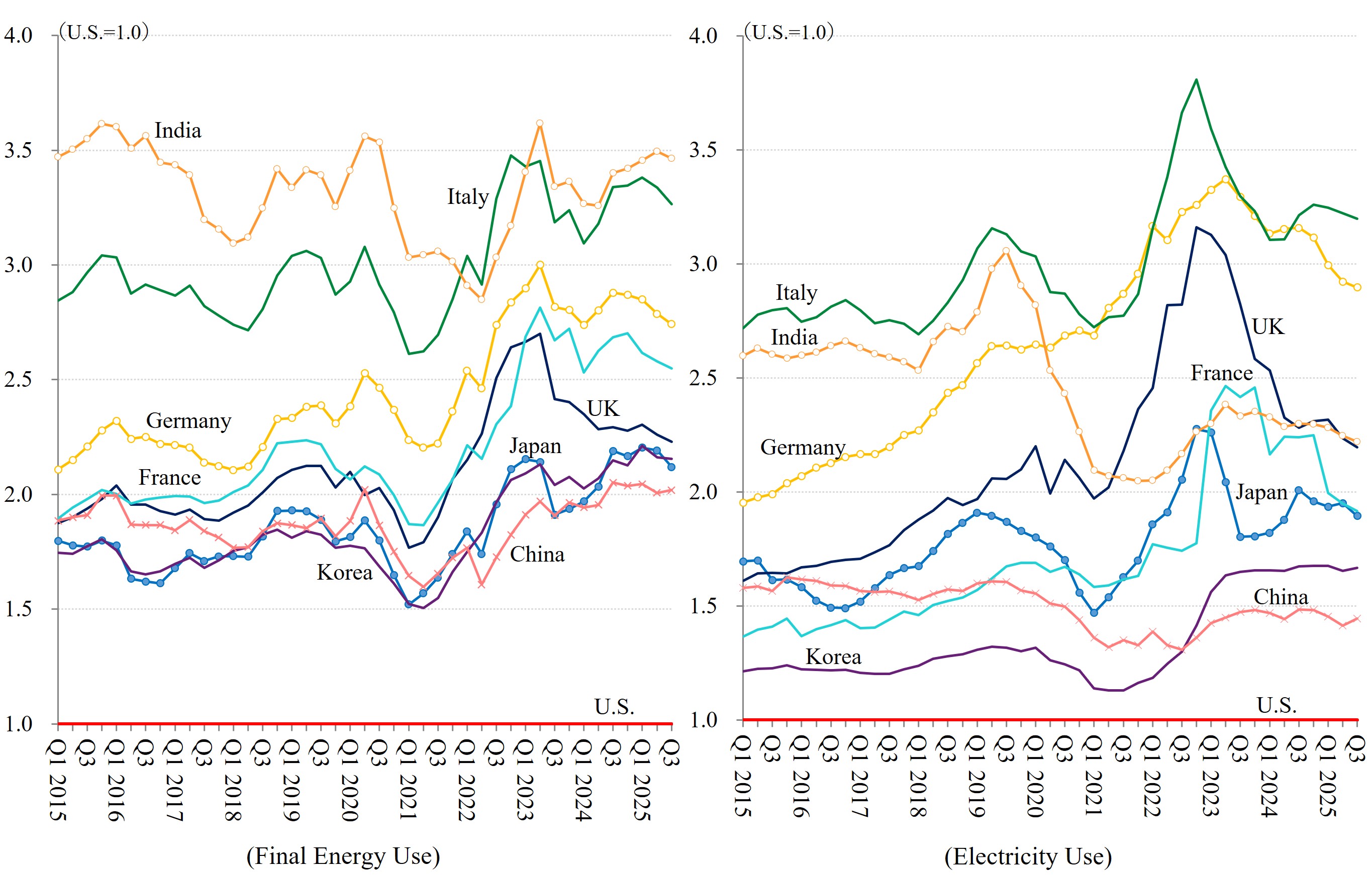

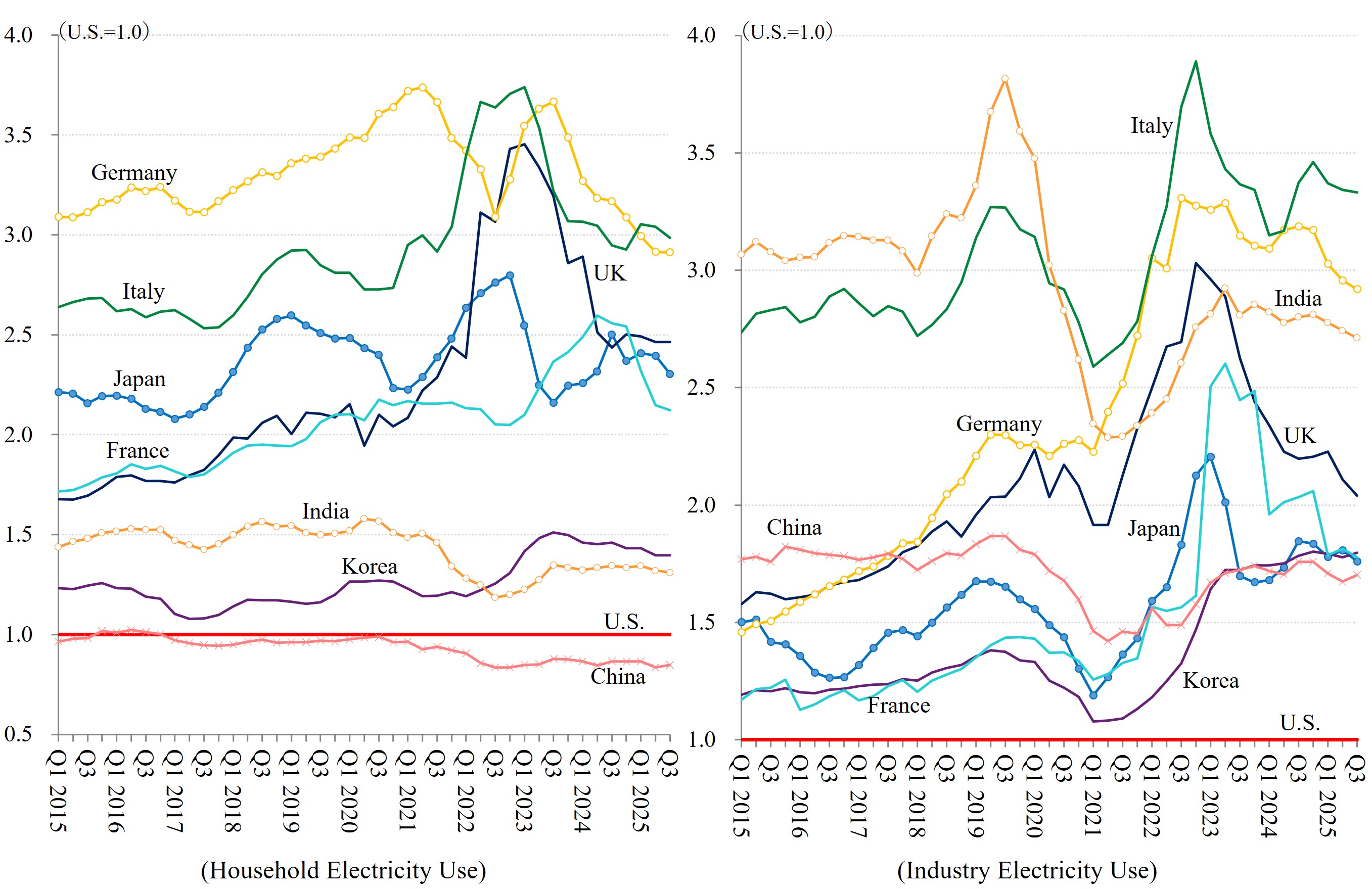

Real PLI (Real Price Level Index for Energy)

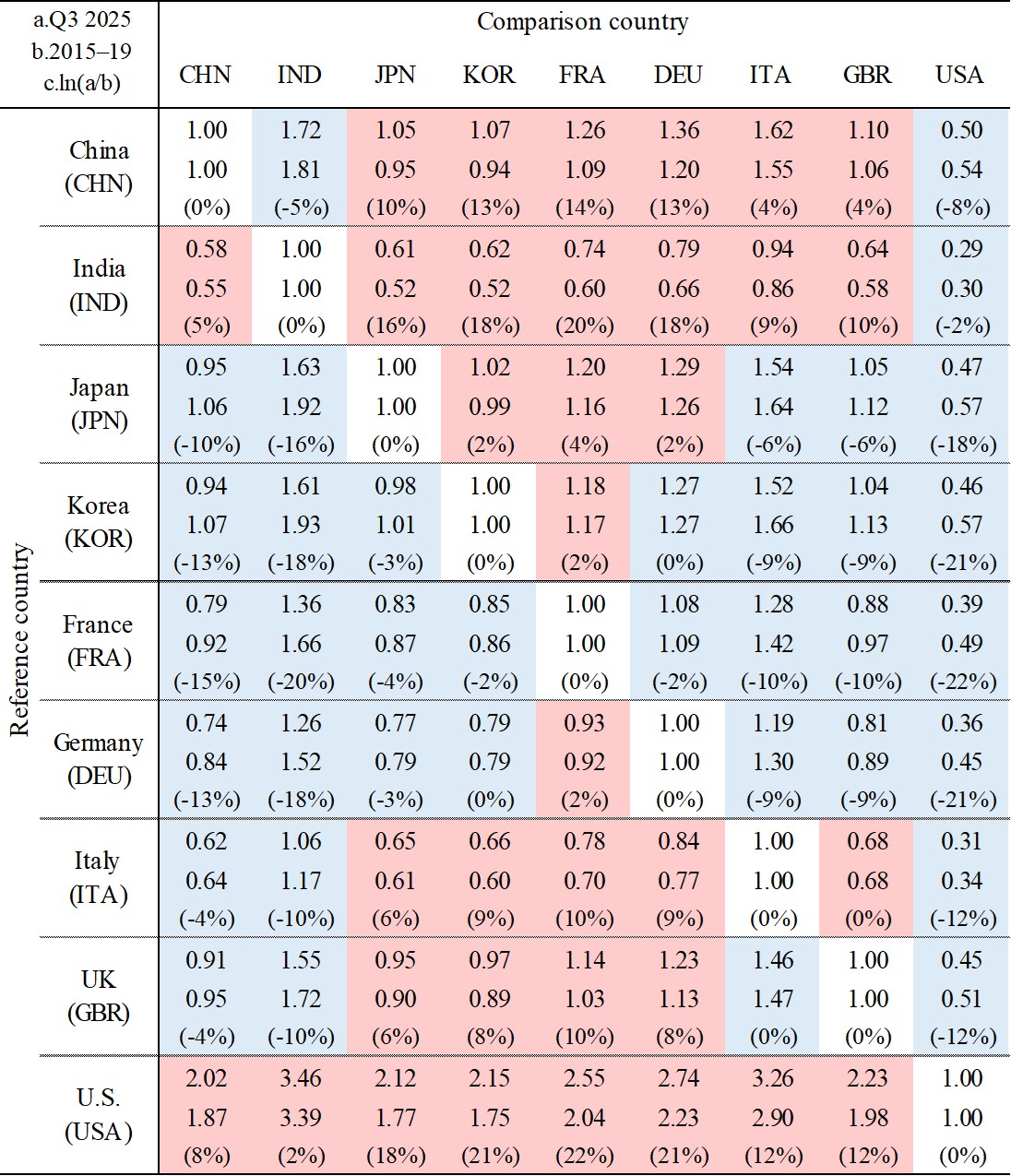

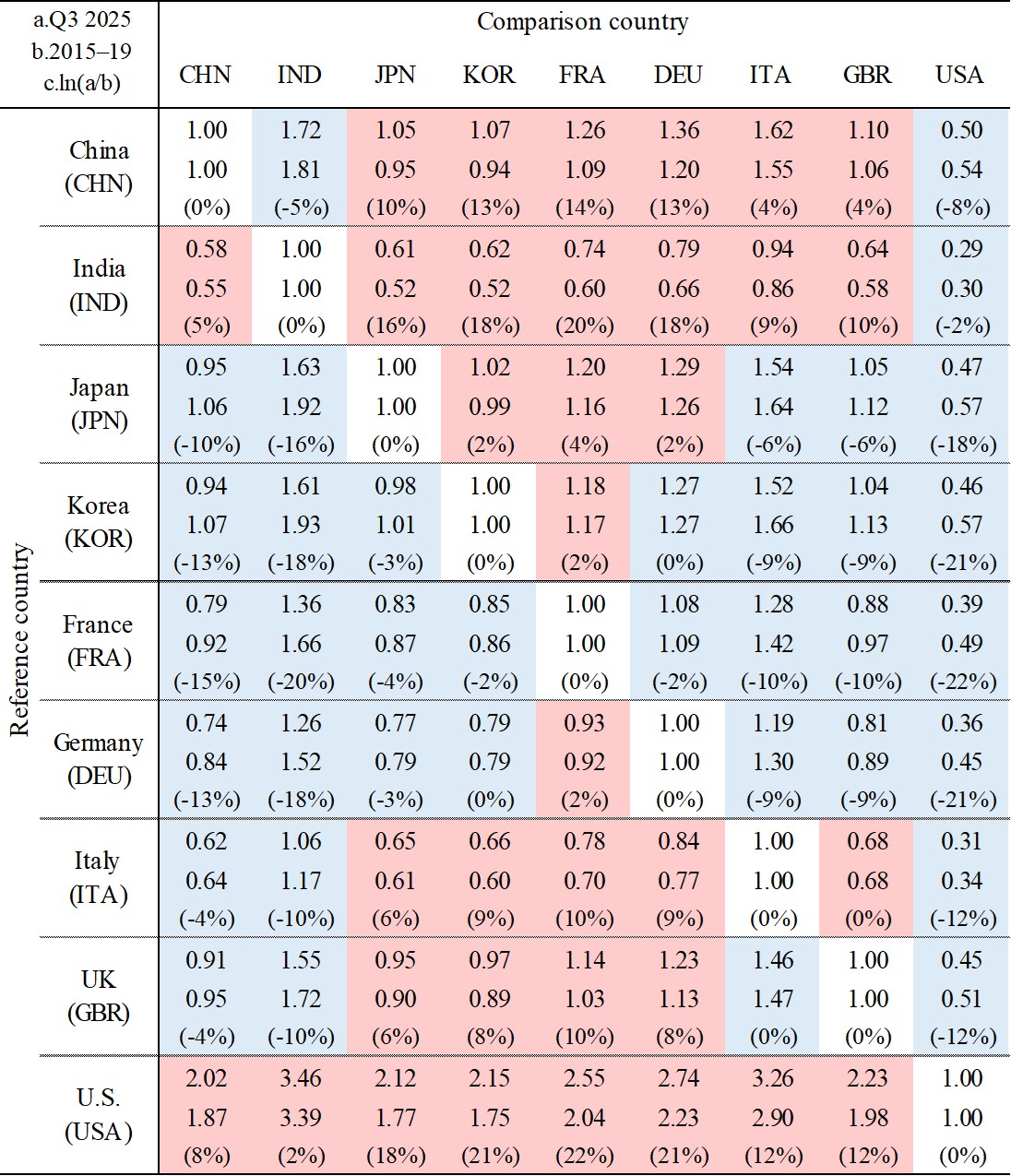

Real PLI Matrix

The ECM provides a high-frequency indicator — Real Unit Energy Cost (RUEC) and Real Price Level Index for energy (Real PLI) — to measure and compare real energy cost differentials across nine countries: four in Asia (China, India, Japan, and Korea), and four in Europe (France, Germany, Italy, and the UK), and the U.S. The ECM also releases the EITE (Energy-Intensive Trade-Exposed) Output Index.