Last Update:2026-01-10

ECM

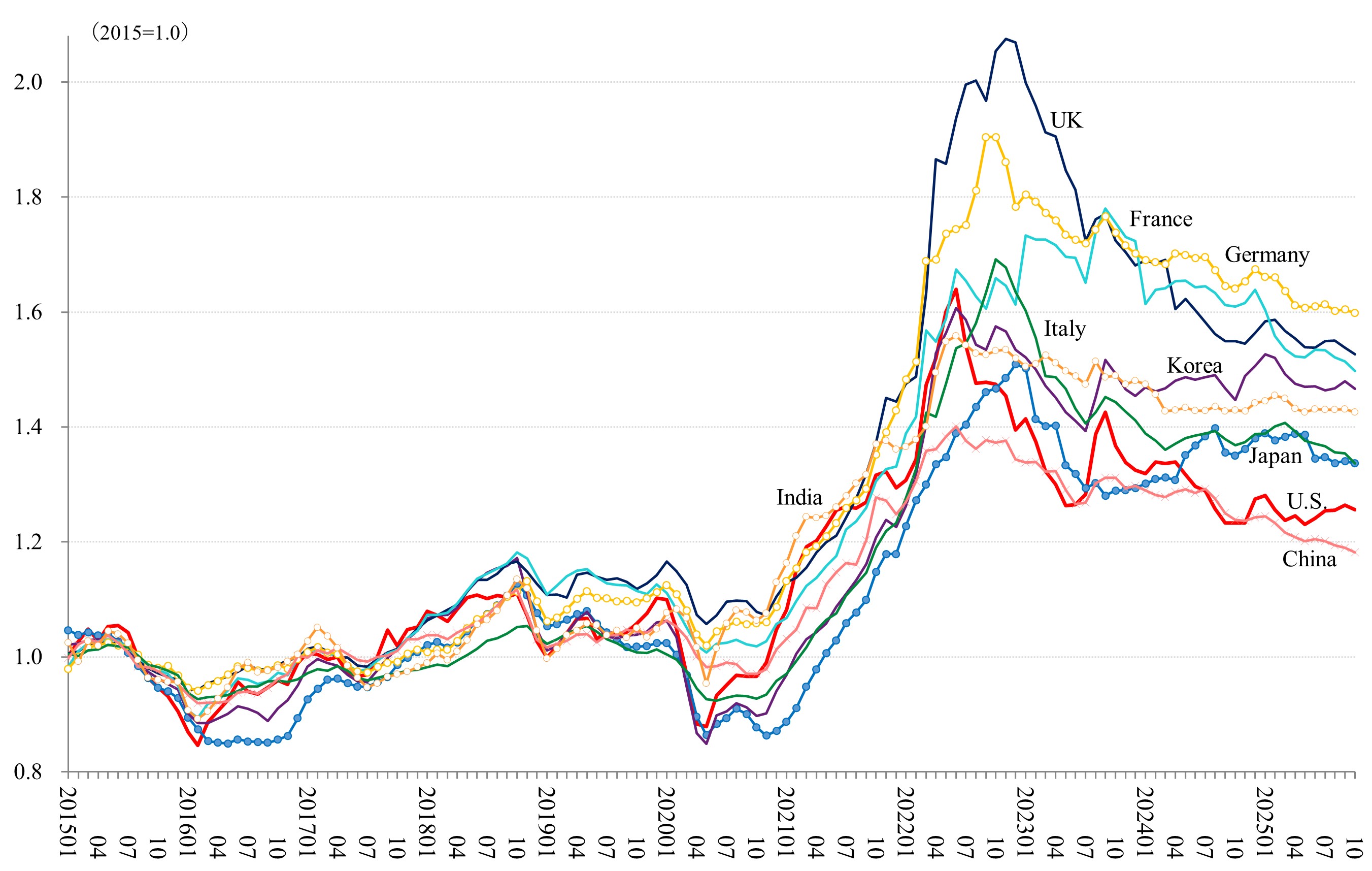

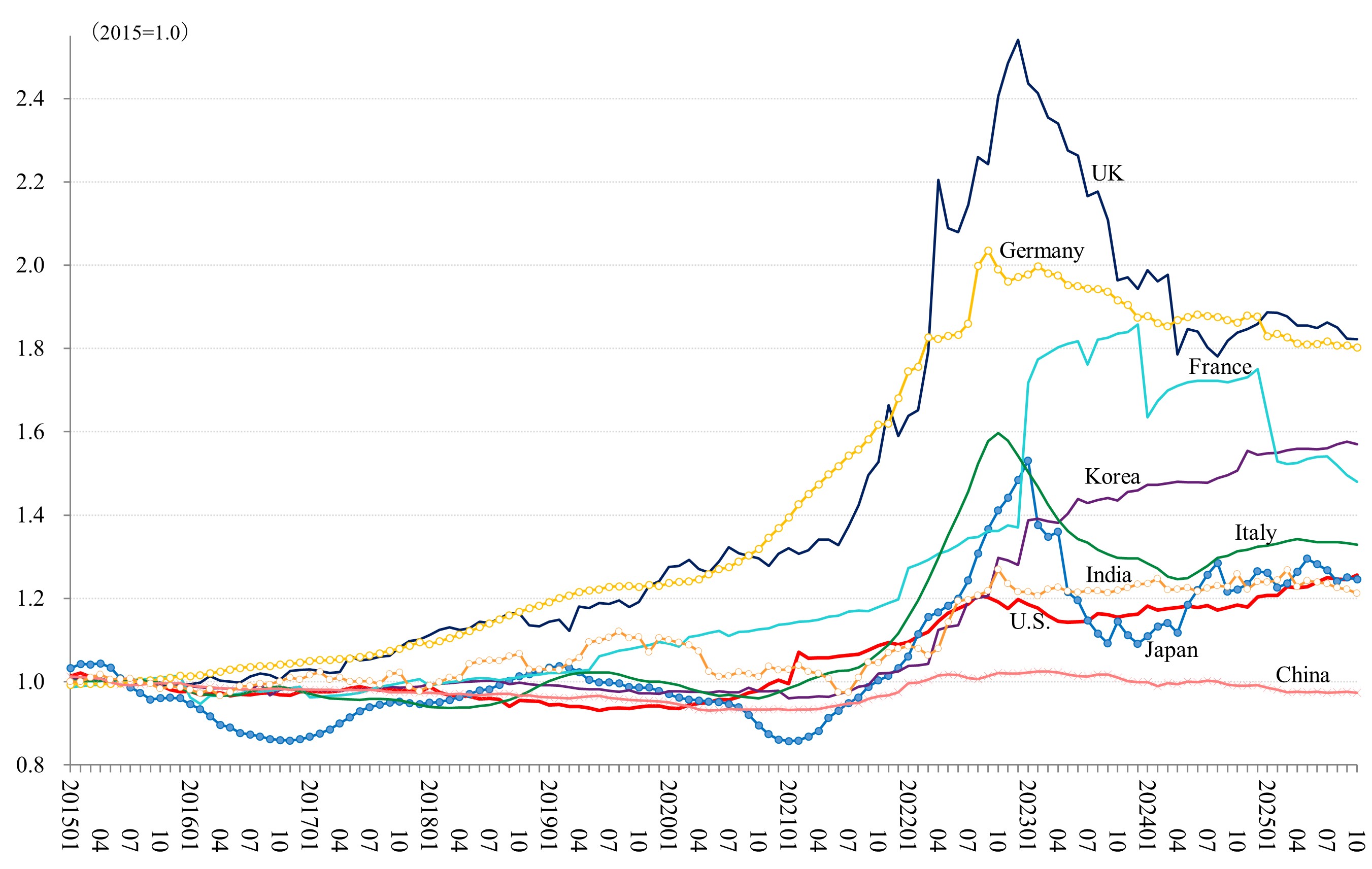

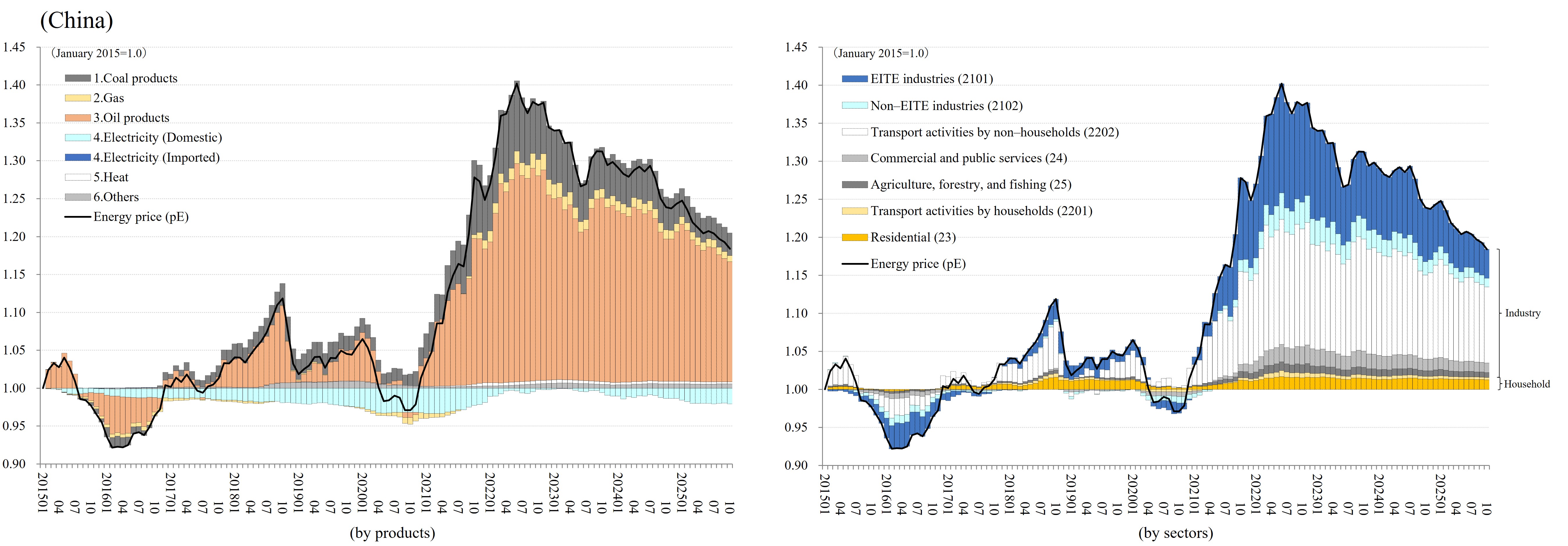

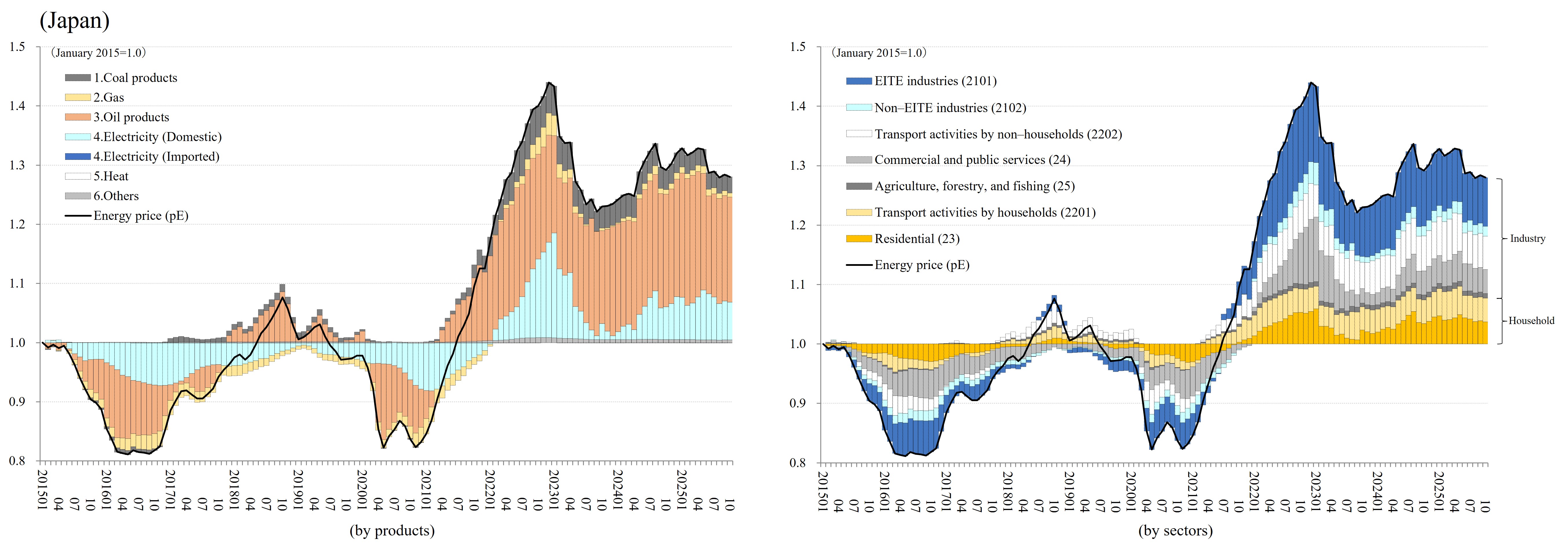

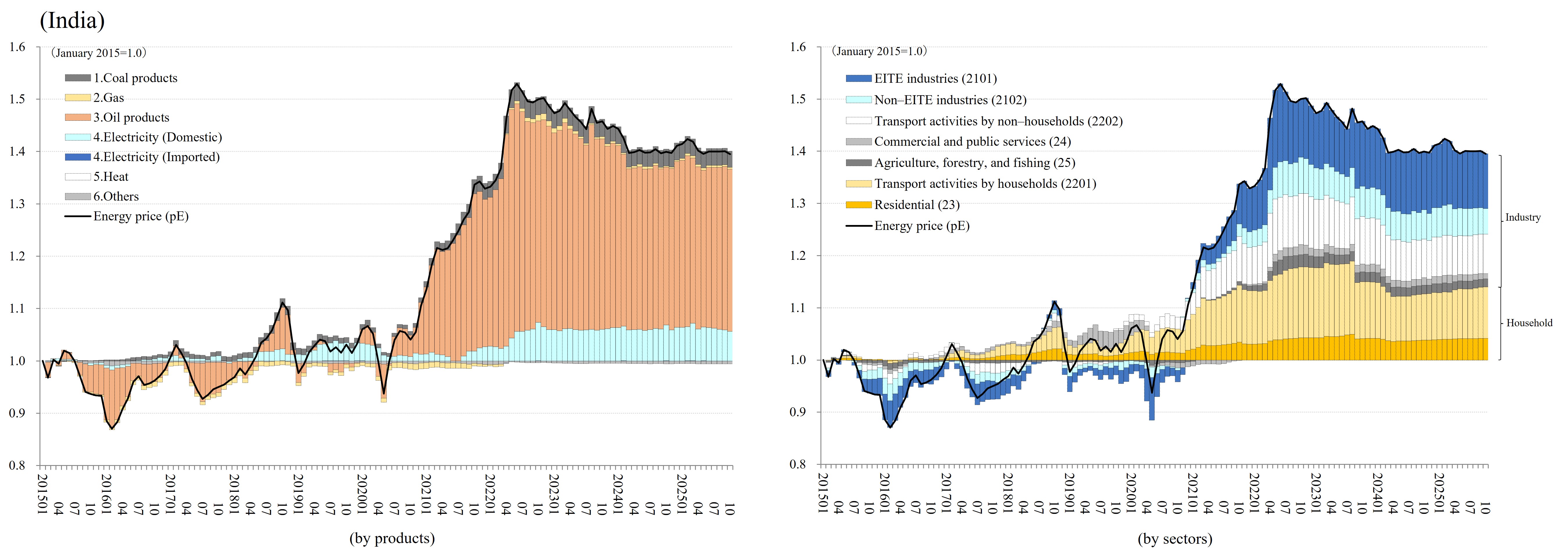

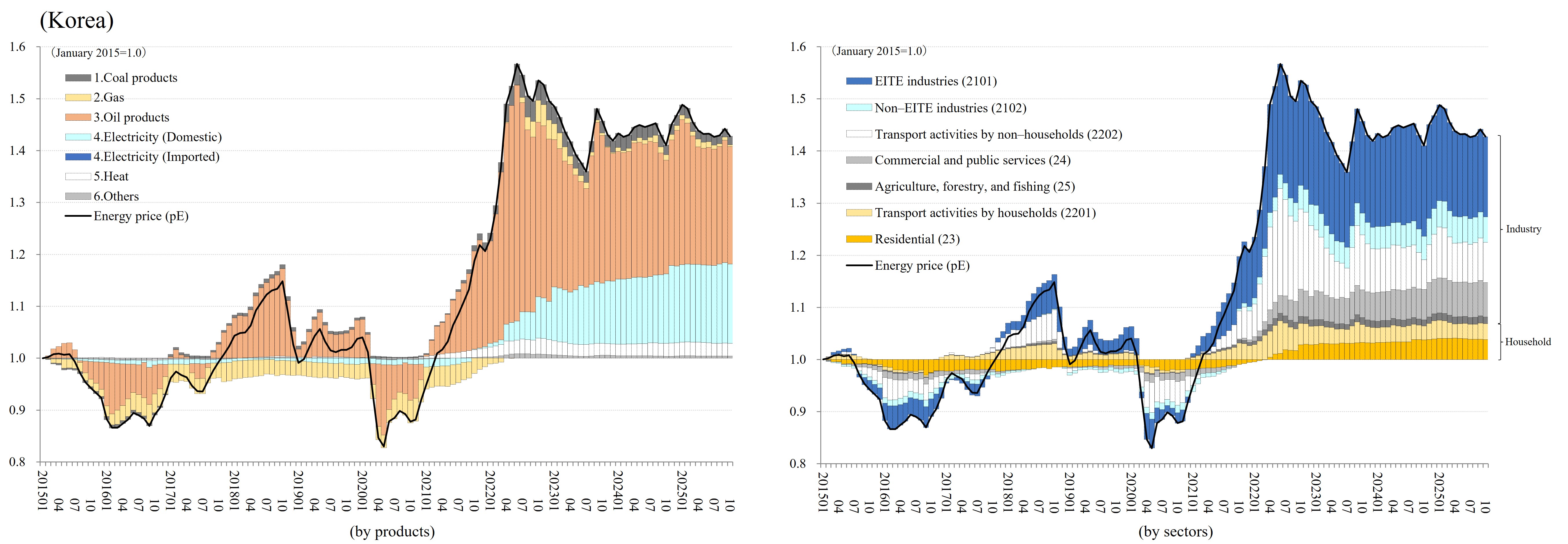

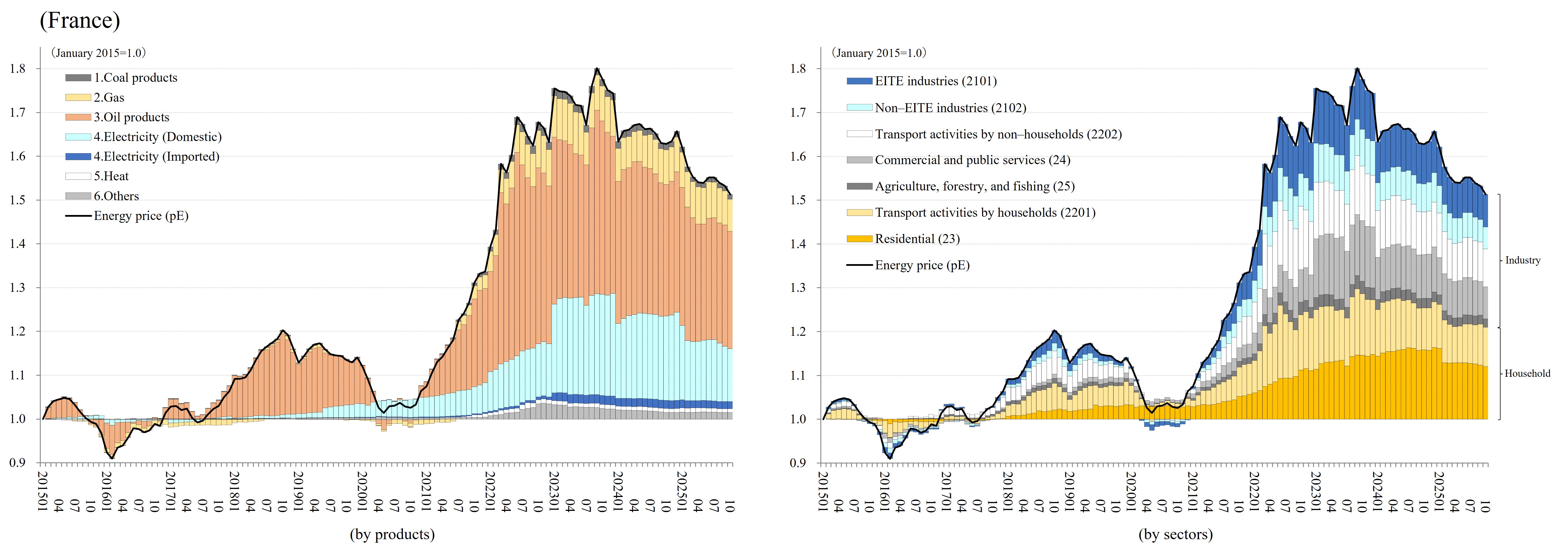

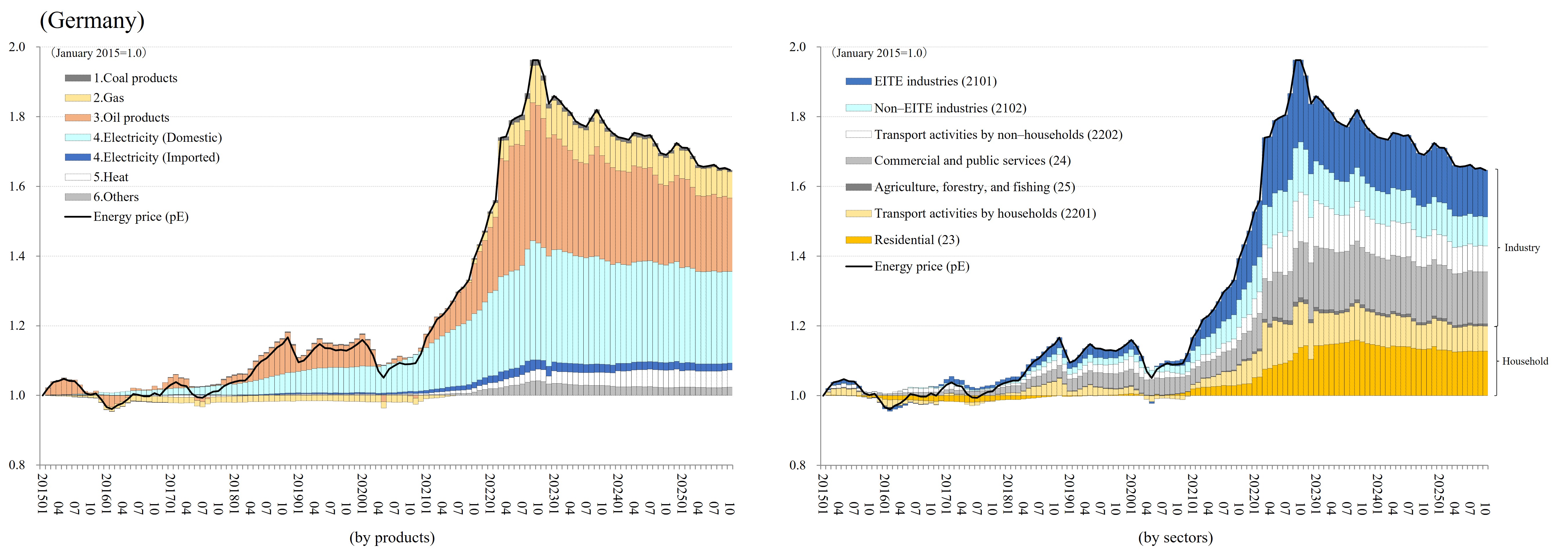

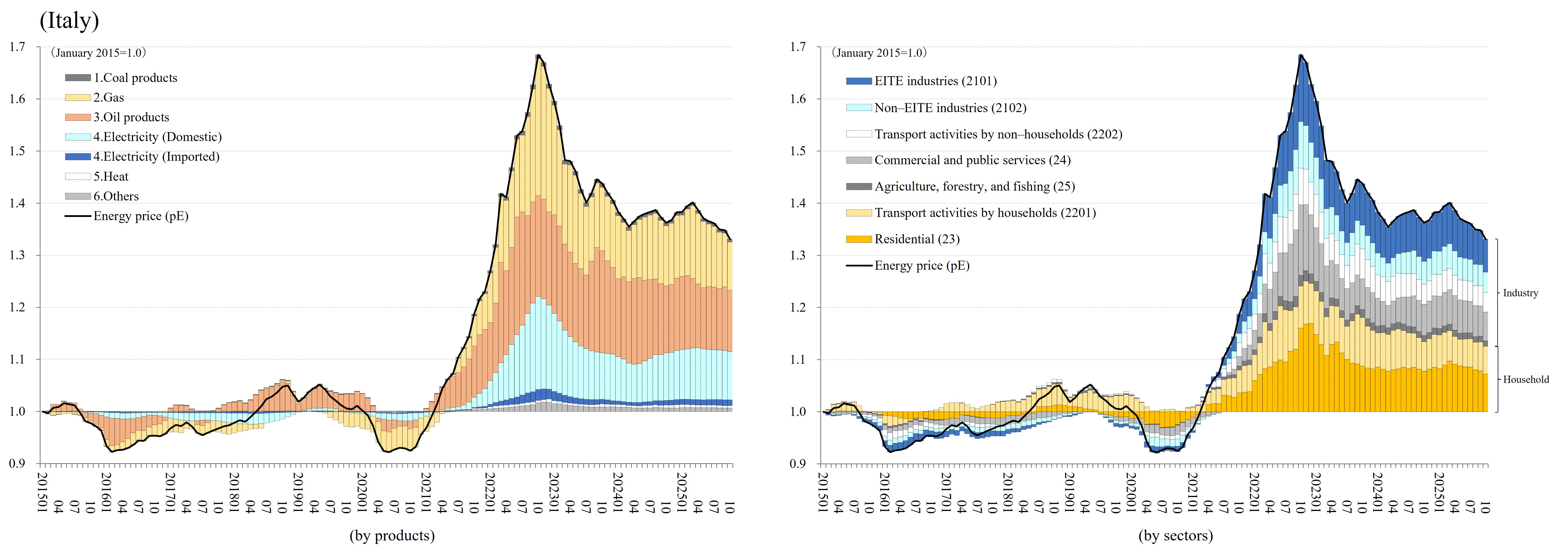

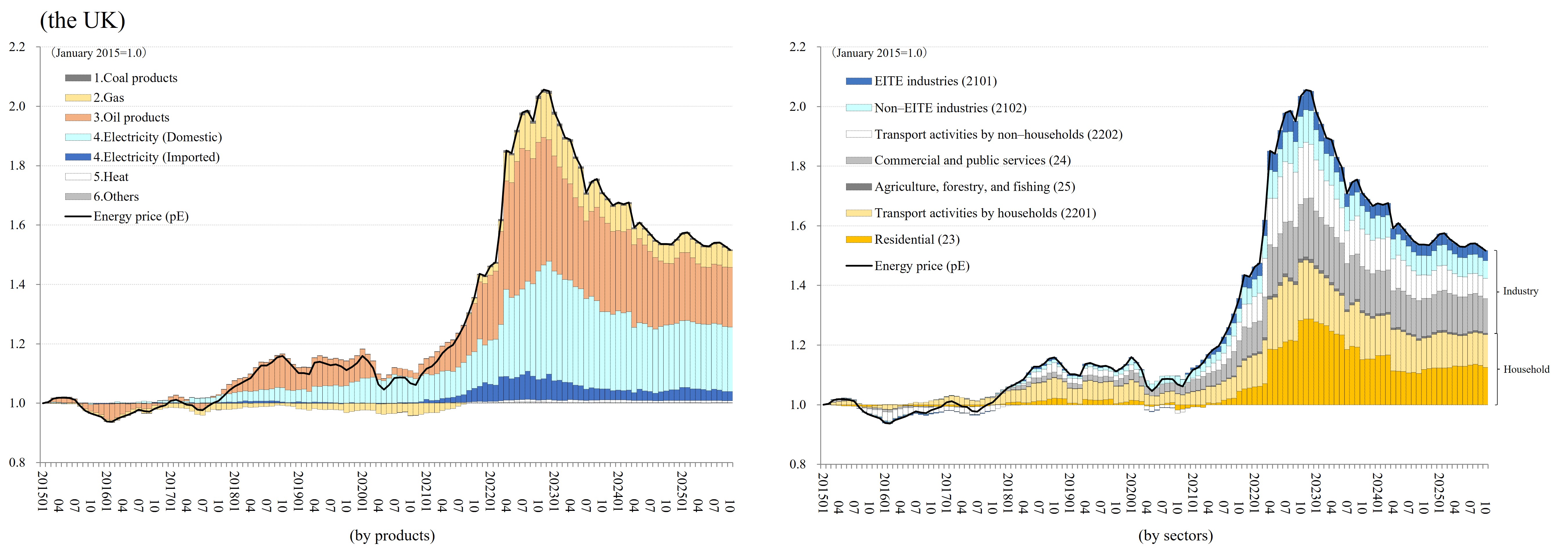

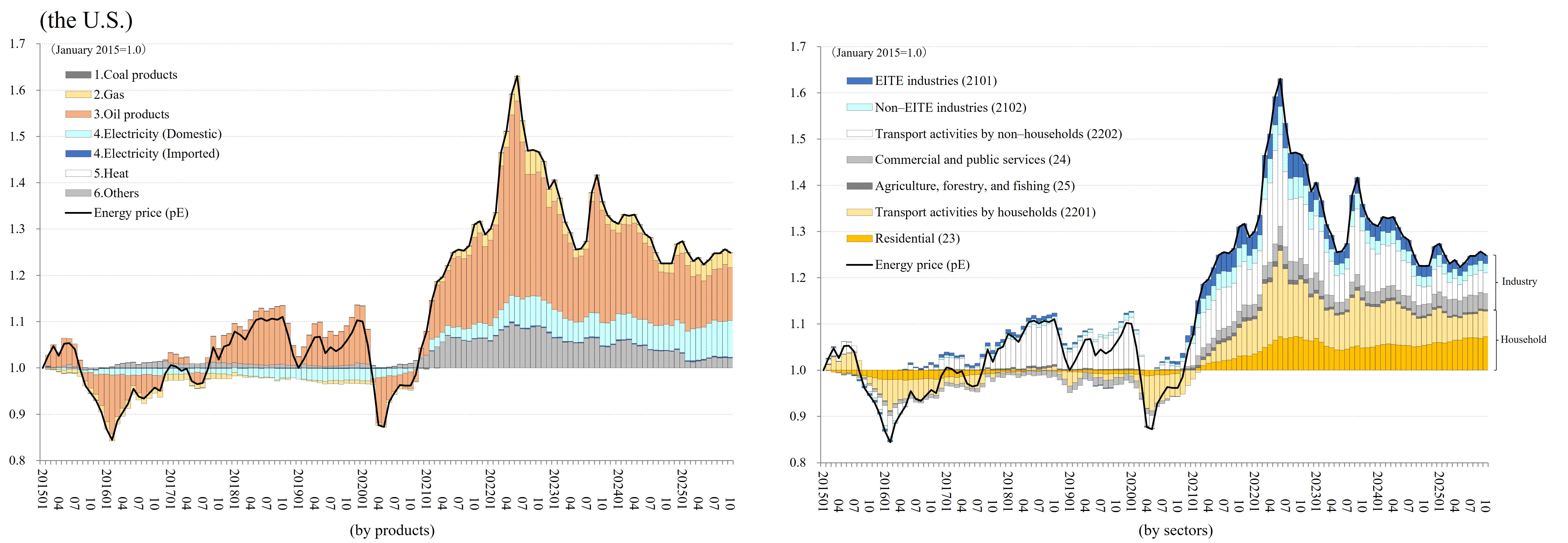

The ECM provides a high-frequency indicator — Real Unit Energy Cost (RUEC) and Real Price Level Index for energy (Real PLI) — to measure and compare real energy cost differentials across nine countries: four in Asia (China, India, Japan, and Korea),

and four in Europe (France, Germany, Italy, and the UK), and the U.S. The ECM also releases the EITE (Energy-Intensive Trade-Exposed) Output Index.

Highlights from ECM202512

- Real PLIs indicate that the real energy price differentials against the U.S. have widened by 12-22% compared with 2015–2019 average.

- While energy prices have declined from their peak, they continue to hover around 20% to 60% above the 2015 level.

- Except for India and China, EITE output remains sluggish, down by about 8% to 22% from 2015 levels.